What's in Store for Remodeling in 2023? Harvard Answers

Harvard’s Joint Center for Housing Studies produces the Leading Indicator for Remodeling Activity (LIRA), a useful tool to anticipate where the market is going.

Recent LIRA data showed about 10% growth for remodeling spending in 2021 and 15% in 2022. It also looks to be around 3 to 4% in revenue growth for next year.

I want people to understand we’re not going to see a contraction in the industry, but the growth is going to be more muted. It’s a more stable, sustainable kind of growth.

What Does Slower Growth Mean?

A slightly softer market might actually be a relief for some remodelers, especially for companies with a lot of backlog. It will also help people who’ve been challenged getting their projects done by problems with materials and/or labor. I don’t think this will be as severe of a downturn compared to what we’re seeing the new home construction industry.

There are a few reasons for remodeling’s continued relative health. Right now, people have a lot of equity in their homes, and they’re staying in those homes for longer than they have in the past. With that in mind, they’re more likely to be spending on repairs and improvements. That’s going to remain a stable supply of work for the remodeling industry.

However, some of the more discretionary projects—kitchen, bath, things that are potentially aesthetic in nature—are where we’re going to see less growth.

Inflation has driven prices way up, and sticker shock may keep people from moving forward with those discretionary improvements.

RELATED: Challenging Affordability Environment Offers Opportunities for Remodelers

A Deeper Dive

Remodeling slowdowns tend to follow housing market slowdowns, are typically shorter and less severe than new construction.

It’s no secret that rapidly rising interest rates are currently driving a housing market slowdown, but there are numerous tailwinds that we expect to support an expanding remodeling market.

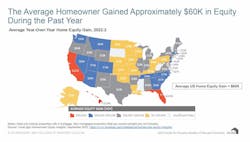

One of the most significant drivers of this market is home equity, as I mentioned earlier. We’ve had an intense surge of house price appreciation since the beginning of the pandemic. Nationally, home prices are now 65% above the last peak back in 2006. Homeowners have record levels of equity today, and that’s a real driver of remodeling.

Even if homeowners are not tapping directly into that equity to finance a project, it’s still a confidence booster to know that the value of your home has increased so quickly.

Other Headwinds and Tailwinds

There are both strong headwinds and tailwinds impacting the remodeling market.

The headwinds include rising interest rates that will pinch equity-based project financing, and the increased costs of labor and materials creating resistance in homeowners. In addition, the risk of a recession brings uncertainty.

But the tailwinds are numerous. We have record levels of home equity, an aging housing stock, and older homeowners who may want to age in place. Also, while the exact numbers are not yet known, I think it’s clear that there will be a permanently higher number of people working from home at least part of the week, and that supports remodeling. Finally, the Inflation Reduction Act provides money for home improvements as well.

Advice for Remodelers

I would advise remodelers to think about the kinds of jobs they do. If you tend to work on more discretionary projects, then look for competitive advantages, such as selling yourself as an energy remodeler or a boutique remodeler who does a certain kind of thing. You will then be more likely to get that segment of the market that may not have been in your region yet.

Carlos Martín is director of the Remodeling Futures Program at the Joint Center for Housing Studies at Harvard University.