On the heels of an inconsistent 2012 market, remodelers are slightly more optimistic headed into 2013. The improving housing market, low interest rates, and the close of the presidential election season are some of the factors behind the optimism. Regionally, East Coast remodelers are expecting a slight bump in business due to projects related to Hurricane Sandy; however, they do not expect this to make up the bulk of their business in 2013.

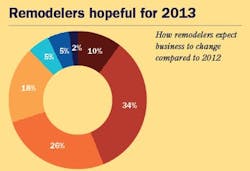

Approximately 70 percent of remodelers expect revenue to increase in 2013, according to the latest Professional Remodeler research. Eighteen percent of remodelers expect no change to their revenue stream in 2013, while 12 percent expect revenue to decrease.

“Consumer confidence is on the rise, people are staying in their homes longer, wanting to update, and adapting their homes to their family and lifestyle,” says Craig Durosko, founder and chairman, Sun Design, Burke, Va.

That optimism contrasts with the end of 2011, when remodelers were very pessimistic about increasing their revenue in 2012. In last year’s Market Forecast survey, 48 percent of respondents expected their revenue to increase, 23 percent expected their revenue to decrease, and 29 percent expected no change to their 2012 revenue when compared to 2011.

The presidential election, natural disasters, an improving housing market, and record low interest rates are driving projections of strong gains in home improvement through the end of 2012 and into 2013.

“During the post-presidential election, people tend to settle in and spend money, and spend wisely—and we all know home remodeling is a wise way to spend money,” says Jason Parsons, remodeler project designer, Design Build Pros, Toms River, N.J. “Also, the aftermath of Hurricane Sandy, is going to create a major need for remodeling and custom new construction in our home market in New Jersey for the next several years.”

Because of the late-year bump in remodeling activity, 46 percent of remodelers reported their business increased in 2012 compared with 2011. Meanwhile, 34 percent said their revenue was down in 2012.

“Strong growth in sales of existing homes and housing starts, coupled with historically low financing costs, have typically been associated with an upturn in home remodeling some months later,” says Kermit Baker, director of the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University. “While the housing market has faced some unique challenges in recent years, this combination is expected to produce a favorable outlook for home improvement spending over the coming months.”

From inconsistent to acceleration

The Joint Center’s Leading Indicator Remodeling Activity (LIRA) revealed an inconsistent market in 2012. Last year’s mild winter resulted in an increase in remodeling work in the beginning of the year. After the unexpected increase, remodeling work slowed down during the summer.

What’s in store for 2013?

We asked remodelers what they expect to see in the remodeling market next year. Here are some of their answers.

“The economy should pick up in general, which will allow more dollars to flow into the remodeling market. Real estate markets are coming back, people generally feel confident again about buying a home, mortgage rates are the best in years.”

“Through my personal friends, social media, as well as mainstream media, I am seeing an increasingly strong focus on healthy living and ‘family-centric’ lifestyles. The desire to live more ‘consciously’ will create a need to remodel homes by well-educated, ultra-professional remodelers, and not simply the lowest cost provider.”

“We are banking on continued pent-up demand, access to fairly inexpensive financing and boredom—boredom coming from Washington not changing...again. We saw this kick in after the mid-terms where people realize that the status quo is simply that and only they, the homeowners, can affect change.”

“We are projecting another 12 percent or so growth into next year.”

“The LIRA is projecting an acceleration in market activity beginning in late 2012, and strengthening as we move into next year,” says Eric S. Besky, managing director of the Joint Center.

The majority of remodelers who responded to our survey shares the LIRA projection for 2013. Eighty-eight percent of respondents are expecting 2013 revenue to either stay flat or increase by more than 25 percent of last year’s revenue.

Lead activity for 2013 is on the upswing as well, despite 31 percent of respondents indicating that their 2013 lead activity will remain unchanged compared with 2012. Nearly 50 percent are seeing more leads for remodeling projects in 2013; 90 percent of those companies have seen leads increase up to 25 percent. Another 6 percent of remodelers indicated that leads have increased more than 25 percent. Twenty percent of remodelers have seen their 2013 lead activity decrease.

“We had fewer leads than previous year, and it was difficult to get clients to commit to moving ahead with projects. Most have been adopting a smaller job size,” says Dave Brady, president, Oak Design & Construction, Oak Park, Ill.

In accordance with the increase in revenue predicted for next year, remodelers are anticipating some growth to the average job size in 2013.

Thirty-three percent indicated no increase or decrease in the average remodeling project, while 55 percent anticipate larger jobs and 12 percent smaller jobs. Two-thirds of remodelers expect the average job size to be +/- 10 percent of where it was in 2012.

“2012 was certainly more profitable for us in central Ohio. Not only did we have a small uptick in volume, but also the size and scope of the projects seemed to be little more to our liking,” says Bill Owens, founder and president, Owens Construction, Powell, Ohio. “The repair/replace/maintain side of the business is still there and represents a fair amount of our work but we saw a few larger design/build projects.”

Even though growth is expected in revenue and job size in 2013, remodelers remain skittish when it comes to adding more employees. Only 30 percent plan to add to their staff next year, while 6 percent indicated they would be reducing employees. Sixty-five percent of respondents indicated they would not change their current staffing levels for 2013.

Only a small portion of respondents (3 percent) plans to cut prices in 2013, as remodelers continue to try to protect their margins. Forty-three percent of remodelers are increasing their 2013 prices, and 53 percent responded they are keeping their prices the same next year.

“Revenue enhancement is a good thing if profitability is commensurate. I would much rather do a smaller volume at a higher profit than a ramped-up volume at less profit,” says Owens. “There is too much risk in what we do for this to be a volume-based business. Our mark is and always will be high single or low double-digit net profit. We won’t plan for anything less and I think our pricing structure does in fact dictate that we will lose some work to the competition. Let them win the project at a low margin and the same amount of risk.”

Just because growth in the remodeling market has been predicted, many remodelers plan to hold steady when it comes to investing in their marketing efforts. Sixty-three percent indicated no change from their 2012 market budget. Only 29 percent are increasing their marketing budget, while 8 percent plan to spend less than they did in 2012.

Slightly more than two-thirds of remodelers plan to spend their marketing budget in three areas: websites, networking, and e-mail marketing.

Websites continue to garner most of the marketing dollars, as 29 percent of respondents plan to spend more on their sites in 2013—this on the heels of increased marketing dollars put toward websites in both 2012 and 2011. Twenty-two percent of remodelers plan to spend more time networking, and 15 percent are increasing their e-mail marketing budget. Social media sites like Twitter and Facebook, which garnered nearly a quarter of marketing budgets in 2012, have been reduced to less than half of that figure for 2013.

Print advertising, direct mail, online referral sites, and home shows make up the top areas of reduced marketing dollars in 2013.

The challenges remodelers expect to face in 2013 are the overall economy, competition from other remodelers, managing cash, and finding qualified employees, which make up close to three-quarters of the responses.

Consistency in the remodeling market is also a concern for remodelers. “One of our biggest challenges has been consistency in the market. We are busy one month, slower the next,” says Durosko. “It is a challenge to staff for the ups and downs and we are looking at how we can create more consistency in sales and revenue next year.”

“The remodeling market can be best described by fits and starts. Busy, slow, busy, slow. Inconsistent,” says Brady.

Opportunities are plenty for remodelers in 2013 as new clients, continued work with clients for life, new technology, and diversification make up approximately 80 percent of responses.

Specific market segments are expected to see an uptick in 2013 as well.

“I expect to see an increase in kitchen and bath remodels as these projects are the ones most with the highest direct value/usage for people,” says Brady. “The other argument for this is, if people are thinking about selling in the near future, these spaces must be in excellent condition for their houses to be marketable at the price point they want.”

“Kitchen projects will continue to be a large part of our business as they have evolved into multifunctional entertaining spaces,” says Parsons.

“Kitchens and baths is the strongest segment by far as it the most appealing to owners to invest in these days,” says Owens. “It seems like kitchen and bath remodels are a value based, best bang for the buck. Repair, replacement, and maintenance remains strong as folks still will keep the house in order, at least to some degree.” PR