Special Section: Storm-related work generating opportunities

Hurricanes, flooding, tornadoes, and other natural disasters accounted for more than $110 billion in damages in 2012, one of the costliest years on record, according to the National Climatic Data Center.

This spring, Moore, Okla., was destroyed by a massive EF5 tornado, which took the lives of more than 20 people. Nearly 91,000 Oklahoma residents have filed claims since the storm, and insurance payouts have topped $1 billion. In comparison, Hurricane Sandy caused approximately $70 billion in losses and hundreds of millions in insurance claims in 2012.

This fall, the National Oceanic and Atmospheric Administration predicted there will be seven to 11 named hurricanes, including three to six that are expected to rank as Category 3 or higher.

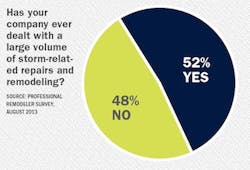

In a recent survey conducted by Professional Remodeler in August 2013, just over 50 percent of remodelers have dealt with a large volume of storm-related repairs and remodeling projects, a number that might soon rise.

Risk of profit slippage

Eighty-five percent of respondents indicated they live in the Northeast, Midwest, or South, each of which have been affected by hurricanes, floods, or tornadoes in recent years. Thirteen percent of respondents indicated they live in the West, which has been impacted by wildfires that have caused severe damage in residential areas. The remaining 2 percent of respondents indicated they conduct their remodeling work outside of the U.S.

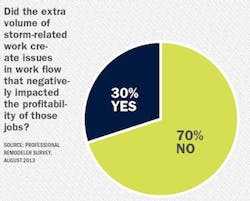

When responding to storm-related work, 70 percent of remodelers say the extra volume of work did not create issues such as workflow that negatively affected the profitability of those jobs. The remaining 30 percent indicated there were problems or issues that did impact the profitability of those jobs.Fifty-four percent of respondents indicated there is an enhanced risk of profit reduction when taking on storm-related repair and remodeling jobs. The other 46 percent indicated there was no risk taking on storm-related repair and remodeling jobs.

In terms of the risks for profit slippage associated with storm-related jobs, 17 percent said an insurance adjuster underestimates the cost of repairs; 13 percent indicated delays in processing of insurance claims as a risk; 12 percent noted profit loss may come due to the additional time spent with an insurance adjuster; 12 percent indicated that insurance companies tend not to pay enough; and 12 percent said the nature of the storm damage means there is often hidden damage and costs.

?While it is true insurance companies delay processing claims, underestimate costs, and want to negotiate, I do not base my business on or accept only insurance companies? figures, and my contracts specifically address that issue,? says one New York-based contractor. ?Cost of the repair is cost of the repair, no negotiations. The quality of the work speaks for itself.?

If remodelers are faced with contracting a large number of jobs in the wake of a large local storm, 53 percent of remodelers indicated they might be at significant risk of losing money; however, only 24 percent believe that contracting a large number of jobs in the wake of a large local storm presents a significant risk that might lead to their company going out of business.

Profits and margin adjustments

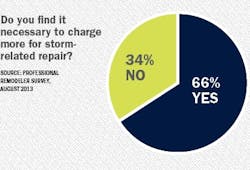

In an effort to accommodate profit slippage, 66 percent of respondents adjust their target gross margin to account for the complexity and extra demands of storm-related repair and remodeling services. The remaining 34 percent do not adjust their target gross margin.

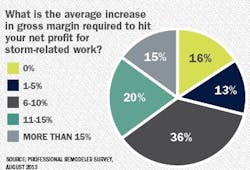

Eighty-four percent of respondents increase their margin required to achieve a target net-profit for storm-related work. Thirteen percent increase their gross margin by 1 to 5 percent; 36 percent increase their gross margin between 6 and 10 percent; 20 percent increase their margin 11 to 15 percent; and 15 percent increase their margin by more than 15 percent.Existing jobs in the wake of a storm

When storm-response is necessary, remodeling contractors often are working on other projects at that time. Seventy-four percent of remodelers do not stop progress on existing jobs to respond to storm-related work, while 26 percent indicated they do stop work on jobs to respond.

In terms of specific reasons to stop production on current jobs to attend to storm-related inquiries, 38 percent indicated that it would be due to a desire to help past clients; 30 percent said the company has a duty to serve the community as much as possible in a time of need; 15 percent indicated that it is an opportunity to acquire new clients; and 9 percent said the reason was to boost short-term revenues.

The remaining 8 percent of respondents indicated ?other.? Detailed responses included: ?Only stop long enough to help clients secure their home, about a week?; ?Temporary slow down of existing jobs to seal up storm-damaged properties?; ?We would only stop work in progress with the clients? consent and to affect emergency repairs on the homes of our past/existing clients or close referrals?; and ?Only for emergency situations usually for former clients?.

Only 27 percent of respondents indicated they prepare for storm-related work by stockpiling tarps, generators, fuel, and other materials in advance of a threatening storm. The remaining 73 percent indicated they do not stockpile emergency-response materials prior to a storm.

Storm-related payouts

Seventy-three percent of respondents indicated they are less than satisfied with the amount of money insurance adjusters allow for the labor portion of an insurance payout. The remaining 27 percent indicated they are more than satisfied with the labor payout, and only 1 percent of this group responded ?completely satisfied.?

Methodology

219 remodelers answered the survey via the Internet in August 2013. Participants were a random sample of subscribers to Professional Remodeler and Professional Remodeler e-newsletters.

Sixty-two percent of respondents said they are less than satisfied with the amount of money adjusters allow for the materials portion of a payout. Thirty-eight percent are satisfied with the amount of a materials portion of a payout. Similar to the labor payout, only 1 percent of the group is completely satisfied with the amount of money insurance adjusters allows for the materials portion of a payout. PR