Private equity firms are notoriously tight-lipped about their strategies, but even a cursory look at investment activity over the last few years uncovers an accelerating migration into the remodeling market. The trend could signal a significant shift in the industry, specifically for home improvement companies.

“Historically, private equity firms avoided cyclical industries like remodeling,” says Matt Ogden, head of Building Industry Partners, a private equity investor that has until recently avoided residential remodeling companies. “Over time that’s changed.”

Until the turn of the century, private equity activity wasn’t especially robust. In 2000, investments amounted to about $500 billion globally, while today it’s closer to $4 trillion, according to McKinsey & Company, a global management-consulting firm.

Yet the industry’s prevailing attribute is, and has always been, risk aversion. It’s a guiding principle of the investor type and it’s been the single greatest factor in keeping those funds out of remodeling, an industry assumed to be rife with risk.

“The cyclicality, moderate annual growth rate, big upturns and downturns, its fragmentation—these factors of the remodeling industry are risks private equity investors have historically been avoiding,” says Abbe Will, researcher and associate project director of the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University. Will, who’s done research into the role private equity now plays in remodeling, says that the nature of construction and remodeling doesn’t offer the obvious stability private equity investors tend to prefer. “It’s made the industry unattractive,” she adds.

Warming to remodeling

In the last 20 years, the number of private equity firms has doubled and the amount being invested has increased 700%. It has firms rethinking industries previously avoided, like home improvement.

“Investors used to lump remodeling in with construction, not realizing that while they exist under the same umbrella the industries operate differently,” Ogden says. “The more firms look into remodeling the more nuanced their analysis and thinking has become.”

Investors discovered the industry was not as much of a gamble as they’d previously thought. “They found that remodeling is conducive to 10%-plus EBITDA, or 25%-plus return on asset profile,” he says. “It’s less cyclical than new construction and more resilient to downturns.”

Ogden, whose firm is currently moving towards investing in the residential remodeling market, is particularly keen on the industry’s low customer concentration.

“In private equity, you think a lot about risk. If you’re a production home builder and you have a large part of your business tied up with a single client, that’s a lot of risk exposure to that single customer’s performance and credit worthiness,” he says. “Remodeling has smaller jobs and more clients.”

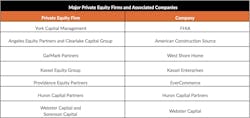

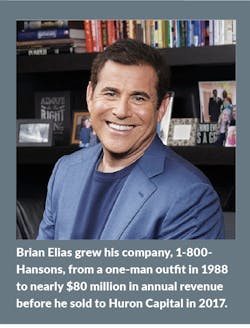

As private equity has learned the industry, investors have made greater inroads into it. We saw it in 2017 when Huron Capital purchased a controlling stake in 1-800-Hansons, a replacement window, roofing, and siding company founded in Detroit. We saw it last year when York Capital Management backed Florida Home Improvement Associates (FHIA) to expand through the purchase of Statewide Remodeling, the largest specialty remodeler in Texas. We saw it earlier this year in July when West Shore Home made its fourth acquisition in 18 months, made possible by financing from GarMark Partners.

Finding A Home In Home Improvement

The attributes private equity investors find attractive in remodeling are most pronounced in home improvement companies.

“I can’t say I have a lot of data on the matter, but what we saw was replacement or specialty contractors are more attractive to private equity investors,” researcher Will says. She gives private equity-backed American Exteriors and RF Installations as examples. “They’ve seen success in engaging with those types of companies.”

Home improvement contractors are known for higher numbers of projects, with a lower price per job. Statewide, for instance, purchased by FHIA on private equity’s dime, generated $61 million in revenue from over 4,000 individual jobs in 2019.

Maybe most compelling, investor Ogden says, is home improvement’s exceptional resistance to recessions, as we saw following the mortgage meltdown. From 2007 to 2011, combined annual spending on kitchen and bath remodels and room additions fell by $43 billion. Meanwhile, exterior replacement spending not only didn’t drop but increased its share of overall spending by more than a third to 23%, according to Harvard’s Joint Center for Housing Studies.

What To Expect Now

Considering the private equity investments already made into the industry, and the effect money like this has had in other industries, home improvement companies can expect considerable changes, some that come with long-term implications.

Here are five outcomes we anticipate:

Consistency and growth are hallmarks of private equity. Bain & Company’s 2020 Global Private Equity Report found that for the last decade firms have averaged annual returns of 15.3%. One avenue for that growth is consolidation, says HomeAdvisor chief economist Mischa Fisher.

“Consolidation is a very common private equity playbook,” says Fisher, who’s observed the inroads private equity has made into home improvement. “They want to find a market they can dominate in order to secure super normal profits.”

In remodeling, the prevailing brand of private equity consolidation, at least so far, is a roll up. “Private equity investors love the ‘roll up,’” he says. “A firm finds a type of business in an industry it likes and buys up a whole bunch of them.” In other words, a roll up links a number of smaller companies—sometimes under a single brand—and leverages the combined resources and knowledge to gain prominence in the market.

West Shore Home, for instance, is a roll up. FHIA, which since August 2019 has purchased both Statewide Remodeling in Texas and Mad City Windows and Baths in Wisconsin, is another roll up, and one that owner Mel Feinberg says is likely to get bigger. “We are looking to expand in other areas of the country, specifically in hurricane and storm-impact zones.”

Roll ups can look different depending on the private equity firm orchestrating them, and the home improvement field will probably experience more than one. Some investors will retain the original brands, others will combine them, while still others will find a space in between. RF Installations, for example, is a roll up of companies purchased by the same stakeholder where the acquisitions are further linked by a uniform marquee.

FHIA’s businesses “may eventually operate under the same banner,” Feinberg says. For now each company is maintaining its brand.

2. Turnarounds and Build Ups

Not all private equity firms operate the same. “Some investors, called ‘turnaround firms,’ go after more troubled businesses that they can get for less money,” explains Ogden.

A troubled business may be one with strong fundamentals but too much debt, in which case the investor may not make many changes to management or strategy, but rather supply resources and optimization. Some businesses are troubled because of mismanagement. Those companies should expect more changes to the business and its management, Ogden says. “If you’re buying a C business, you’re going to come in with a thesis on how you’re going to improve that business right away.”

That’s not the approach Building Industry Partners takes. “We prefer to buy good businesses at prudent valuations and support their vision,” owner Ogden says. It’s also not an approach popular in home improvement.

Statewide Remodeling, for instance, acquired by FHIA through York Capital Management, is Texas’ largest remodeling company and it’s not the stated intention of FHIA to change much about the business. “Statewide Remodeling is a great company, and we’re not looking to change that,” Feinberg says. The purchase was to bring in Statewide’s bath remodeling expertise, he says, and the strategy moving forward will be to leverage resources across its other businesses—a common private equity tactic. “We will be expanding product lines and services across each company we acquire based on the needs of homeowners in each market.”

The home improvement industry’s performance during the Great Recession has been a selling point for private equity investors. The pandemic has only highlighted that resilience. “Exterior contractors are particularly attractive,” Ogden says. “Siding, roofing, windows, landscaping—if you can do it without too much interior work during this time, that’s a good thing.”

Still, despite the industry’s ability to withstand or avoid altogether some of the worst impacts of COVID-19, businesses are not sitting on extra capital. As of June, 27% of remodelers said they could operate with lowered revenues for only one to three more months before facing “financial difficulty or possibly closure,” according to data from The Farnsworth Group and Home Improvement Research Institute. Private equity can help ensure financial security in tough times.

A 2017 study from the National Bureau of Economic Research found that private equity-backed businesses tend to outperform industry competitors during economic downturns. It reads: “This result can be explained by the ability of PE-backed companies to... raise equity and debt funding in this difficult period, and to lower their cost of capital.”

West Shore Home is not suffering from a lack of resources, but thanks to its partnership with GarMark, it was able to tap into acquisition credit lines as further protection from the impacts of COVID-19, says West Shore Home owner B.J. Werzyn. “We were lucky to be thinking ahead about this.”

4. Increased Financial Acumen

In 2014, when private equity was first showing up in remodeling, researcher Abbe Will interviewed a number of remodelers who had used private equity investment to see if it was a viable way to achieve scale in the industry. She reported that in their experience one of the “major benefits” of private equity involvement was human capital in the form of “sophisticated financial acumen and best practices development.”

We still see that benefit today. It has certainly been the case for West Shore Home and now FHIA, Statewide, and Mad City Windows and Baths. “We complement each other,” owner Feinberg says. “We bring industry expertise and [private equity] brings strength in finance and mergers and acquisitions.”

5. Industry Spillover

If private equity is here to stay, its impact won’t be limited to the businesses seeing investment. There is likely to be what’s called “industry spillovers,” according to a comprehensive evaluation of private equity impacts on industries conducted by professors Serdar Aldatmaz and Gregory W. Brown of George Mason University and The University of North Carolina, respectively.

The two examined data on 19 industries across 52 countries that had seen private equity investment. They determined that the investment applied pressure to industry competitors to keep pace with performance gains, ultimately elevating the industry overall. The data shows that within one year of private equity investment levels increasing, employment growth in that industry increases 0.6%, labor productivity growth increases 0.8%, and profitability growth increases by 2.9%

About the Author

James F. McClister

James McClister is managing editor for Professional Remodeler.