Americans Kept Fixing Up Their Homes Through the Pandemic

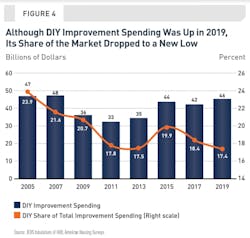

In 2019, four in 10 home improvements were do-it-yourself projects. Yet, despite DIY spending levels remaining relatively stable since 2015, the share of DIY spending that year as it related to all of home improvement fell to a new low, 17% of total home improvement spending.

Among the 25 metros tracked by the 2019 American Housing Survey, the share of DIY activity was largest in a mix of both high- and low-cost markets such as Pittsburgh (22%), Seattle (22%), New Orleans (21%), Portland (21%), and Riverside, Calif. (21%). In contrast, the metros with the lowest shares of spending on DIY projects (less than 13%) were mostly expensive housing markets, including Boston, Chicago, New York, San Francisco, and Washington, DC.

This renewed avidity for DIY work is but one of the byproducts of a pandemic that has been “something of a boon for the remodeling industry, by forcing a variety of housing and lifestyle changes that encourage improvement spending,” the Center asserted.

As the U.S. economy came unglued last year, spending on home improvement and repairs (including rental improvements and maintenance) increased by 3.2% to $419 billion. 2020 was the 10th consecutive year of expansion for the remodeling industry, spurred by pandemic-related nudges that led to a sudden flexibility of remote work, which often created a need for more housing space; and a precautionary migration to larger houses in less-dense and lower-cost areas of the country.

Will this boon outlast the country’s health crisis? The Center thinks so, and expects residential remodeling activity to build steadily in the years ahead. “If the changes in housing choices brought on by the pandemic—the uptick in residential mobility, shifts in household composition, and the focus on home-centered activities—become lasting trends, demand for remodeling projects could be even stronger than currently anticipated.”

Looking for Clues in the Rearview Mirror

The Center sets its report’s prognostications against a detailed recap of the remodeling industry’s recent performance and its causes.

It’s worth remembering that 43% of all homeowners didn’t spend a dime on home maintenance or repair in 2019. A study by the Federal Reserve Bank of Philadelphia and PolicyMap estimated that just to address the deficiencies in America’s owner-occupied housing stock would cost $82 billion, or an average repair cost of $3,100 per house.

Homeowners’ precarious financial straits made remodeling spending less urgent, as nearly two-fifths of owner households lost employment income between the onset of the pandemic and the end of 2020, according to the Census Bureau’s Household Pulse Surveys.

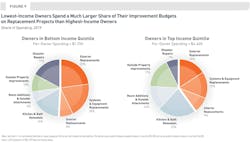

Low-income households were severely hard hit by the virus’ spread and its impact on employment. Even before the pandemic, 68% of owners in the lowest-income quintile spent less than $500 on home improvements and repairs in 2019. But this cohort is still essential to the remodeling sector, accounting for around 10% of national spending each year.

Homeowners at the bottom income quintile spent 14% of their incomes on remodeling projects, almost two times the average share for all owners. Low-income owners also spent significantly more of their improvement dollars on replacement projects in 2019 than owners in the top income quintile. The ability of low-income owners to maintain their typically older, more affordable homes “is critical … for the preservation of the aging housing stock,” the Center report stated.

All told, nearly half (47%) of the spending by all owner groups on houses built before 1980 was for replacement projects in 2019. That was substantially higher than the 20% share spent on homes built since 2010. Average per-owner spending for replacement projects for older homes was $1,500, compared with just $700 for homes built since 2010.

The increasing frequency of natural disasters is also playing an unwanted but unavoidable role in home improvement expectations. In 2019, spending on disaster repairs rose to a new high of $26 billion, representing 10% of total home remodeling expenditures. That percentage was double its historical share, as much of the damage being repaired was caused by hurricanes and tornadoes.

Two-thirds of the total outlays in 2019 were concentrated in the southern U.S. The Center estimates that after a disaster, repair spending on owner-occupied homes is typically spread over three years. And the impact of climate change on the built environment is only likely to get worse: In 2020, there were 22 weather and climate disasters in the U.S. with property losses exceeding $1 billion each.

Some Previous Peaks Have Yet to be Scaled

The remodeling market hasn’t quite recovered fully from past recessions.

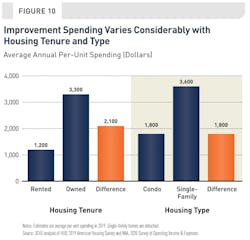

In 2019, homeowner improvements (excluding maintenance) continued to account for fully two-thirds of the remodeling market, with strong gains in both per-owner and total spending. At $3,300, average per-owner expenditures were up 13% from the peak of the housing boom in 2007. In real terms, however, per-owner spending was still 8% below the previous high. Similarly, total improvement spending—discretionary, replacement, disaster repairs, and outside property improvement—grew 19% from 2007 to 2019, to $262.1 billion, but remained about 4% below peak after adjusting for inflation.

Replacement projects (such as upgrades to roofing, siding, windows, systems, and equipment) continued to dominate the remodeling market in 2019, accounting for $120.4 billion, or 46% of total improvement expenditures. Spending on discretionary projects (such as kitchen and bath remodels and room additions) made up $77.4 billion, or 29.5%. These shares have remained essentially unchanged since 2011. 999999 Discretionary projects accounted for 38% or more of aggregate improvement spending in markets with higher incomes and home values (such as Los Angeles, New York, Portland, and San Francisco). By comparison, the discretionary share was 25% or less in several southern metros with disproportionately high spending on disaster repairs in 2019 (such as Dallas, Houston, Miami, and Raleigh).

Older Adults Focus Spending on Replacements

About 30% of homeowners (some 22 million households) reported at least one improvement project in 2019. The metros with the largest shares of top-spending owners that year included Houston (61%), Seattle (56%), Los Angeles (54%), and San Francisco (54%).

Homeowners spending $50,000 or more on improvements accounted for about 39% of the market in 2019, up from less than 30% in 2011 after adjusting for inflation. Even so, top spenders made up an even larger share of the remodeling market from 2005 to 2007 during the height of the housing boom, when they contributed more than 45% of national expenditures.

Homeowners age 55 and older spent nearly $140 billion on remodeling projects in 2019, lifting their share of overall improvement spending to 53% in 2019 from 40% in 2009. Older homeowners—who are much more likely to live in older units and to have longer occupancies—devoted a somewhat larger share of their improvement dollars (48%) to replacing home components and upgrading systems than homeowners under age 55 (44%). Conversely, they spend a smaller share of their budgets (27%) on discretionary projects than younger homeowners (32%). In addition, older homeowners focus somewhat less on making outside property improvements (14%) than younger owners (16%).

Another 2.4 million older owners reported in 2019 that they had plans in the next two years to remodel their homes to improve accessibility.

Reasons for Cautious Optimism

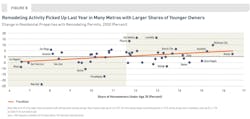

The remodeling market’s biggest speed bump to sustained growth would appear to be the lagging participation of younger Americans as homeowners

Nevertheless, Kermit Baker, the Center’s Project Director-Remodeling Futures, cites an “upturn” in younger households purchasing homes as one of his reasons for optimism about remodeling expenditures ahead. Baker also expects homeowners who deferred large and small projects in 2020 to complete those projects once the pandemic subsides. He notes, too, that multigenerational households are increasing, and remote working “has given people more locational flexibility and the desire to modify their homes.” Each of these has potentially positive implications for remodeling spending.

The Center projects that if 1 million households transitioned from renting to owning in a given year, national home improvement spending would increase by $2 billion on an ongoing basis. And if pandemic-induced lifestyle and work changes stick long term (vacant offices to affordable housing, anyone?), Baker thinks they could fuel remodeling activity in the U.S. “for years to come.”

About the Author

John Caulfield

Contributing editor John Caulfield writes about issues affecting the new-construction, exterior-replacement, and remodeling industries. He is a senior editor with Professional Remodeler's sister publication Building Design + Construction.