Remodeling Market Remains Housing's Bright Spot

NAHB Chief Economist Dr. Robert Dietz’s presentation to members at the Fall Leadership Meeting in late October contained some starkly negative statistics, such as housing is in a recession. But many remodelers breathed a combined sigh of relief when Dietz added that conditions for their sector, though slowing, should remain positive for the near term.

In fact, Dietz expects a small increase in remodeling activity in 2023, in contrast to new construction, which is expected to decline. High interest rates are having a more negative effect on new construction, and with growing home equity, working from home, and an aging housing stock, remodeling market conditions are expected to remain strong.

What Remodeling Data Says

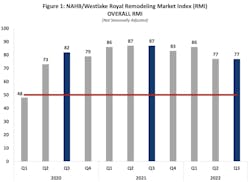

Citing the NAHB/Westlake Royal Remodeling Market Index (RMI) for the third quarter of 2022, Dietz said the overall reading of 77—unchanged from the reading for Q2 and down 9 points from Q1 of 2022—remains relatively strong.

The RMI survey asks remodelers to rate five components of the remodeling market as “good,” “fair,” or “poor,” with each question measured on a scale from 0 to 100, where an index number above 50 indicates respondents view conditions as good rather than poor.

RELATED: Do You Have a Healthy Marketing Mindset?

The RMI is also an average of two major component indices: the Current Conditions Index and the Future Indicators Index. The Current Conditions Index is based on an average of three subcomponents, depending on a project’s size and cost, while the Future Indicators Index is an average of two components; the current rate of leads and inquiries and the current backlog of projects. While both subcomponents were down from Q3 2021, they still remain well above 50, at 82 and 71, respectively.

Remodelers Report Relief

Dietz expects the remodeling market to expand during the current housing downturn, as homeowners request more space to work from home, increased energy efficiency amid growing climate concerns, and the trend of aging in place.

“It’s definitely the one bright spot on the horizon,” said Kurt Clason, NAHB Remodelers Chair and owner of Clason Remodeling Co. in Ossipee, NH. “While nearly all sectors are showing a decline with the housing downturn, strong demand for remodeling will allow us to continue with moderate growth.”

“Though labor shortages will still be a challenge, all indications are that many families will choose to stay where they are with their low interest rates and make their home everything they need. And it’s what I love doing,” said Nicole Goolsby, a Remodelers council member and owner of Red Ladder Residential in Raleigh, NC.

The remodeling market is still dealing with the many overarching issues affecting the housing market: the increasing costs and availability of both materials and labor, rising interest rates, and burdensome regulations that contribute to overall affordability concerns.

RELATED: Retrofit Push Benefits Remodelers

The most recent Leading Indicator of Remodeling Activity, released in late October by the Remodeling Futures Program at the Joint Center for Housing Studies at Harvard, projects year-over-year growth in homeowner remodeling and repair spending to shrink nearly 10% from 16.1% in 2022 to 6.5% by Q3 2023.

The market is undoubtedly slowing from the unsustainable growth rates that followed in the wake of the pandemic-induced recession, said Carlos Martín, the project’s director.

Spending for home improvements will continue to face headwinds from declining home sales, rising interest rates, and increasing costs of labor and materials. But remodeling should also see gains from homeowners with record levels of home equity to support renovation financing. And energy-efficiency retrofits incentivized by the Inflation Reduction Act and disaster repairs following recent hurricane activity will support the expansion of the home remodeling market to almost $450 billion in 2023, according to the Harvard report.

All good news for NAHB remodeler members during challenging economic times.