Wondering how the inauguration of an administration that has declared itself to be business friendly will affect your roofing, siding, window, or other short-cycle home improvement business? It might affect you in three areas: health care, taxes, and OSHA regulation.

Health Care

Candidate Trump’s campaign promises included the “prompt repeal” of the Affordable Care Act, also known as Obamacare. The ACA, which extended health insurance coverage to 20 million Americans, has many provisions, including a mandate that individuals have health insurance or face tax penalties, as well as one for business owners with companies employing 50 or more to provide health insurance or pay a fee. For companies with 25 or fewer employees making less than $50,000 in annual wages, the ACA “offers incentives, such as tax breaks and tax credits via the Small Business Health Options Program.”

According to a New York Times article, Trump’s first executive order “directed government agencies to scale back as many aspects of the Affordable Care Act as possible, moving within hours of being sworn in to fulfill his pledge to eviscerate Barack Obama’s signature” health care bill. The order “gave no specifics,” the story points out,“but its broad language gave federal agencies wide latitude to change, delay or waive provisions of the law that they deemed overly costly for insurers, drug makers, doctors, patients or states, suggesting that it could have wide-ranging impact, and essentially allowing the dismantling of the law to begin even before Congress moves to repeal it.”

But the elimination of the ACA and its various parts and pieces will not be immediate. A different story in the same paper made the point that the Trump executive order lacks the force and authority of legislation and was more on the order of a mission statement. Many small companies, including home improvement companies, do not offer health insurance because owners feel they can’t afford it, and those who do make insurance available have increasingly turned to cost sharing. A recent Kaiser Family Foundation study shows 57 percent of U.S. employers offer health insurance, though cost sharing has become the norm in the last 15 years - the 16 percent of small companies offering health insurance on a cost-sharing basis in 2005 had become 63 percent in 2015.

Eliminating the ACA individual mandate is expected to drive up the cost of health insurance, as the young and healthy may once more take their chances and elect to go without insurance, leaving fewer people—more of whom are in higher risk groups—to shoulder all of the costs.

Would repeal be good for you and your employees? Not if your company qualifies for those ACA tax credits or, if employees responsible for their own health insurance are no longer able to pay for it because subsidies are eliminated. "We don't think (a repeal) would be realistic. Many small businesses have gotten coverage they wouldn't have gotten otherwise," says John Arensmeyer, CEO of Small Business Majority, quoted in USA Today. Small Business Majority has supported the law.

Taxes

Trump has repeatedly vowed to slash taxes and offered a plan which, as Salon and other media point out, overwhelmingly favors those in the highest income brackets (they would receive 50 percent of reductions). Trump’s tax plan would reduce tax brackets from seven to three (12, 25, and 33 percent), and raise the standard deduction while eliminating many itemized deductions. A Forbes article includes tables with the proposed new tax brackets and capital gains rates, and also points out that eliminating the net investment income tax, which Trump would also do, would bring the actual top tax rate to 33 percent from an effective 43 percent. In addition, the article says that Trump favors a small-businesses income tax that matches the 15 percent corporate tax rate he has proposed.

OSHA Safety Enforcement

Washington employment law firm Ogletree Deakins noted soon after the election that “Trump’s victory has conventional wisdom predicting that his administration will defang the Occupational Safety and Health Administration in several ways.” Why OSHA? Trump, a developer, “has been fined multiple times by OSHA for safety violations at his worksites,” notes Safety+Health magazine, which goes on to predict a big shift from active enforcement of OSHA standards to “compliance assistance,” that is, voluntary compliance. More specifically, Eric J. Conn, quoted by Safety+Health, suggests that the rule requiring employers to submit injury and illness data to OSHA, which can then be published on the agency’s website, may be the first regulation to be eliminated.

Another change, according to Ogletree Deakins, would be to “put the Severe Violator Enforcement Program (SVEP) on the chopping block.” The majority of firms cited under SVEP, in effect since 2010, are construction companies, including many roofing companies with multiple OSHA violations and subsequent fines. Falls top the list of hazards.

But don’t look to the new administration to eliminate OSHA, which, as with the Affordable Care Act, can only be done by passing a law. In addition, says Stephen Lee at Occupational Safety & Health Reporter, there would be a high political price paid since “polls consistently show it enjoys strong public support.”

Add new comment

Related Stories

3 Areas Successful Remodelers Focus On

Industry advisor Mark Richardson shares what separates the losing from the winning in today’s market

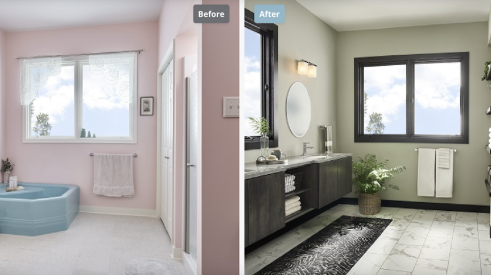

Peppermill Finish

NAHB: Remodelers Face Challenges and Opportunities

Remodelers face a uniquely strong market yet remain challenged by codes and costs

Selling Your Company to Your Team

From company valuation to terms of the transfer, here’s a look at how three different remodelers made the deal work

Re-Bath Expands its Reach with New Franchise

The company signs a deal with brothers who are first-time franchisees

Pro Remodeler’s 2024 Pinnacle Experience Reaches New Heights

The sold-out event covered leadership, lead gen, sales, and technology

Brian Gottlieb Receives Remodeling Mastery Award

Presented by industry icon, Mark Richardson, the award celebrated Gottlieb’s extraordinary impact on remodeling

What's Beyond the Hammer?

Working with Brian Gottlieb on the book Beyond the Hammer provided a masterclass on how to build an aligned team

5 Counterintuitive Strategies to Improve Your Business

Follow these strategies to inspire employees, instill trust, and beat the competition

Couple Act As Much More Than General Contractors

How LBR Partners uplifts and educates their Spanish-speaking trade partners