This spring, Sen. John Chafee (R-R.I.) and Rep. E. Clay Shaw Jr. (R-Fla.) introduced twin bills in the House and Senate. Coined The Historic Homeownership Assistance Act (H.R.1172/S.664), the proposed legislation would provide tax relief for owners of historic buildings.

Without going into full-blown detail, the legislation would establish a 20-percent tax credit to homeowners who rehabilitate or purchase a newly rehabbed house with certain historic value or in a historic district.

The beauty of this legislation is that it would provide not only business opportunities for remodelers, but also a golden opportunity to shed positive light on the industry.

As we mentioned last month, remodelers are often unfairly labeled as anti-environment instead of taking credit for what they are already doing regarding "green" remodeling.

These bills allow remodelers to set themselves firmly on the popular side of issues such as affordable housing, urban renewal, and sprawl. Passage of The Historic Homeownership Assistance Act would enable homebuyers to purchase historic buildings in need of work and remodel them at a reduced cost after the tax credit. Or a remodeler could purchase the property, rehab it, and pass the cost savings from the credit on to the purchaser. Either way, the house is occupied with a reduced price of investment.

Passage of the Act would also encourage property owners to rehabilitate aging housing stock, thereby revitalizing communities and neighborhoods in cities large and small.

From a public relations standpoint, passage of the Act would provide a way for remodelers to step up with a solid solution to uncontrolled sprawl. With the ability to recreate housing and revitalize cities, remodelers can take the high road and derail the sprawl issue.

In any case, introduction of this legislation gives the remodeling industry a chance to influence the nation’s housing.

The bill was introduced with broad bipartisan support: The Senate bill has nine cosponsors; the House version has 84. A full list of sponsors is available at www.house.gov and www.senate.gov. The Capital switchboard phone number is (202) 224-3121.

In talking with legislative staff, the bills have a good chance of passage. A telephone call, email, fax or letter would encourage Congress to follow through and make the bills law.

This is political action that pays off for the industry. Let your voice be heard.

Rod Sutton

Rsutton@cahners.com

Add new comment

Related Stories

NARI Renames Awards Program

The awards program has a new name, but continues its tradition of recognizing the best in residential remodeling

Registration Open for Women in Residential+Commercial Construction Conference 2024

Join 300+ women in construction for three days of impactful idea-sharing and networking in Phoenix

Power Home Remodeling Expands Financing Offshoot with $400M from Goldman Sachs

Industry-leading home improvement company Power plans to grow its fintech offshoot fivefold with new investment

Great Day Improvements Acquires LeafGuard and Englert

Leading home improvement company Great Day Improvements purchases two major brands from private equity firm Audax

Metros with the Highest and Lowest Remodel ROI

First-time homebuyers can find fixer-upper listings priced between 5 to 10% lower than move-in ready homes. The high return on investment of these projects shows that remodeling remains a strong option to navigate the current housing market

Latest Private Equity Activity Signals Continued Strength in Home Improvement

A hot month for private equity means the industry remains opportunity-rich

Pro Remodeler Wins Two Prestigious Jesse H. Neal Awards

The editorial team was honored with one of B2B journalism's most prestigious awards in the categories of Best Subject-Related Package and Best Range of Work by a Single Author

Business Coach Cited in Attorney General Lawsuit Against Contractor

A New England contractor faces a civil suit alleging his company’s growth was tied to a business coach with a model that “encourages fraud"

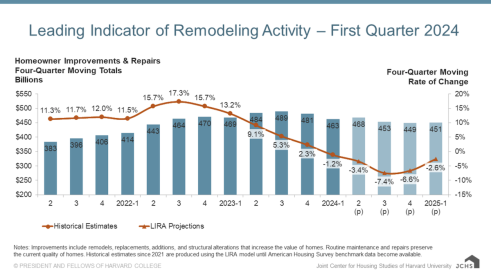

Harvard Says Remodeling Spending Downturn to Slow

Could the drop in remodeling spending from post-COVID levels regulate soon?

Power Home Remodeling Now Offers Subsidized Childcare

The home improvement giant's move seeks to address a greater industry issue