The number of homeowners behind on their mortgages is lower than a year ago, but has ticked up since the first quarter of 2011, according to the latest numbers from the Mortage Bankers Association.

The group reported that 12.87 percent mortgages were either delinquent or in the foreclosure process in the second quarter of the year. That's up slightly from 12.84 percent in the first quarter, but down 143 basis points from a year ago.

"While overall mortgage delinquencies increased only slightly between the first and second quarters of this year, it is clear that the downward trend we saw through most of 2010 has stopped. Mortgage delinquencies are no longer improving and are now showing some signs of worsening," said Jay Brinkmann, MBA's Chief Economist.

On the positive side, foreclosure starts fell to their lowest level since 2007, but the increasing unemployment rate seems to be putting more pressure on homeowners as those loans that are one payment overdue increased sharply.

Foreclosures also continue to be heavily concentrated, with a handful of states accounting for the majority of foreclosure inventory in the second quarter. Florida and California alone have more than a third of the nation's foreclosures.

Related Stories

Peppermill Finish

NAHB: Remodelers Face Challenges and Opportunities

Remodelers face a uniquely strong market yet remain challenged by codes and costs

NAHB Announces Action Plan for Housing Affordability

Six of the proposed 10 action items are important to residential remodelers

Metros with the Highest and Lowest Remodel ROI

First-time homebuyers can find fixer-upper listings priced between 5 to 10% lower than move-in ready homes. The high return on investment of these projects shows that remodeling remains a strong option to navigate the current housing market

What the Most Successful Remodelers are Doing Right Now

Industry advisor Mark Richardson shares the answers to his three most asked questions: What's the remodeling market like? What are other remodelers doing? How do I measure up?

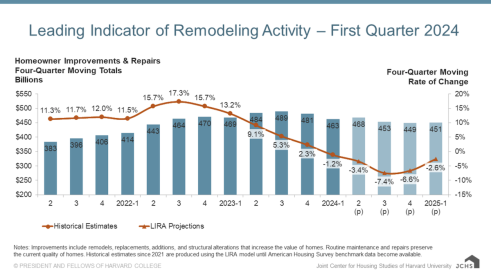

Harvard Says Remodeling Spending Downturn to Slow

Could the drop in remodeling spending from post-COVID levels regulate soon?

How to Increase Your Odds of Closing Remodeling Sales

Use these tips to hone your sales process and grow close ratio

The Remodeling Market Could Turn in Q4, Says Harvard

Repair and remodeling spending could see an uptick at the end of the year

How to Communicate with Today's Cautious Remodeling Client

Amid economic skepticism, Americans continue to spend. Now, how can you get them to spend on remodeling?