During the interviews for this article, we found that there were several areas that were unclear to many remodelers. Here are the answers to some of their key questions.

Q: When the new health exchanges come online in 2014, will high-deductible health insurance policies and their accompanying health savings accounts be eliminated?

A: Under the law, if you like the coverage you have today, you can keep it, according to Health and Human Services spokesperson Jessica Santillo. “Insurers and employers may continue to offer high-deductible insurance policies with HSAs provided that they meet some key insurance market reforms to existing plans,” Santillo said in an email. “For example, in regards to existing plans, the law generally prohibits lifetime limits on coverage and rescission of policies and extends coverage for those up to age 26 if they offer dependent coverage. These changes could impact high deductible plans.”

We think this means that high-deductible health insurance policies won’t be eliminated, at least not by the Feds. The question we can’t answer is whether the insurers will continue to offer these plans.

Q: The tax credit for small businesses that pay for health insurance for their employees doesn’t apply to coverage for the owners and their families. Will the policies sold through the new health exchanges be available to small business owners and their families as well as their employees?

A: Yes, Santillo says. “Small business owners may purchase health insurance through a small business exchange for themselves, their families and their employees. But they can’t count themselves and family members as eligible employees for a tax credit.

Q: Is the new $2,500 limit on contributions to flexible spending arrangements (FSAs) per employee or per covered individual?

A: It’s per employee and is unaffected by the number of family members, according to Bruce I. Friedland at the Internal Revenue Service. If a husband and wife each worked for an employer with an FSA, they could each make a $2,500 contribution. This provision goes into effect starting in 2013.

Q: Is the 1099 reporting requirement that is scheduled to go into effect in 2012 for all businesses, or just those that have to offer health insurance?

A: It’s all businesses, according to the NAHB and the National Federation of Independent Business. There’s a big push, however, to get this provision repealed before it goes into effect in 2012.

Add new comment

Related Stories

Brian Gottlieb Receives Remodeling Mastery Award

Presented by industry icon, Mark Richardson, the award celebrated Gottlieb’s extraordinary impact on remodeling

What's Beyond the Hammer?

Working with Brian Gottlieb on the book Beyond the Hammer provided a masterclass on how to build an aligned team

Real AI Applications For Remodelers

Tech-forward remodeler Michael Anschel shares how he uses artificial intelligence in his business.

How to Eliminate Boring, Languishing Meetings

Leff Design Build ensures maximum productivity and efficiency through these straightforward methods

5 Counterintuitive Strategies to Improve Your Business

Follow these strategies to inspire employees, instill trust, and beat the competition

Couple Act As Much More Than General Contractors

How LBR Partners uplifts and educates their Spanish-speaking trade partners

How to Train for and Run Effective Design-Build Meetings

On this episode of Women at WIRC, Morgan Thomas of LEFF Design Build shares how to maximize your time by creating a culture around effective, collaborative meetings

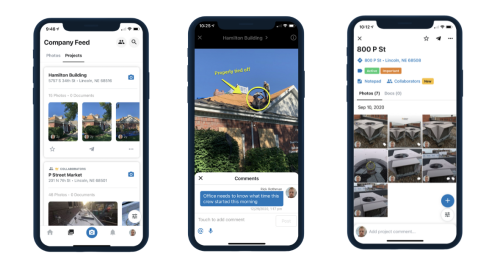

Pro's Picks: A Real-Time Project Communication and Management Tool

This remodeler says this product allows for easy, quick, real-time communication with team members in the field and in the office

How to Create a World-Class Remodeling Team

Great remodeling companies position themselves for the future with the right players

Everyone Should Have a Number: KPIs for Your Design Build Team

Measuring key performance indicators guides your team to success while creating accountability and ownership