Home prices in the U.S. decreased 0.4 percent on a month-over-month basis in August, the first monthly decline in four months.

According to the CoreLogic HPI, national home prices, including distressed sales, also declined on a year-over-year basis by 4.4 percent in August 2011 compared to August 2010. This follows a decline of 4.8 percent in July 2011 compared to July 2010.

Excluding distressed sales, year-over-year prices declined by 0.7 percent in August 2011 compared to August 2010 and by 1.7 percent in July 2011 compared to July 2010. Distressed sales include short sales and real estate owned (REO) transactions.

Some highlights from the report:

- Including distressed sales, the five states with the highest appreciation were: West Virginia (+8.6 percent), Wyoming (+3.6 percent), North Dakota (+3.5 percent), New York (+3.2 percent), and Alaska (+2.2 percent).

- Including distressed sales, the five states with the greatest depreciation were: Nevada (-12.4 percent), Arizona (-10.7 percent), Illinois (-9.6 percent), Minnesota (-7.8 percent), and Georgia (-7.2 percent).

- Excluding distressed sales, the five states with the highest appreciation were: West Virginia (+10.7 percent), Mississippi (+4.8 percent), Hawaii (+4.4 percent), North Dakota (+4.2 percent), and Kansas (+3.7 percent).

- Excluding distressed sales, the five states with the greatest depreciation were: Nevada (-8.8 percent), Arizona (-8.3 percent), Delaware (-4.9 percent), Michigan (-4.3 percent), and Minnesota (-4.2 percent).

- Including distressed transactions, the peak-to-current change in the national HPI (from April 2006 to August 2011) was -30.5 percent. Excluding distressed transactions, the peak-to-current change in the HPI for the same period was -21.0 percent.

- Of the top 100 Core Based Statistical Areas (CBSAs) measured by population, 80 are showing year-over-year declines in August, eight fewer than in July.

"Although the calendar says August, the end of the summer traditionally marks the beginning of 'fall' for the housing market as it begins to prepare for 'winter,'" said CoreLogic chief economist Mark Fleming. "So the slight month-over-month decline was predictable, particularly given the renewed concerns over a double-dip recession, high negative equity, and the persistent levels of shadow inventory. The continued bright spot is the non-distressed segment of the market, which is only marginally lower than a year ago and continues to exhibit relative strength."

Related Stories

Peppermill Finish

NAHB: Remodelers Face Challenges and Opportunities

Remodelers face a uniquely strong market yet remain challenged by codes and costs

NAHB Announces Action Plan for Housing Affordability

Six of the proposed 10 action items are important to residential remodelers

Metros with the Highest and Lowest Remodel ROI

First-time homebuyers can find fixer-upper listings priced between 5 to 10% lower than move-in ready homes. The high return on investment of these projects shows that remodeling remains a strong option to navigate the current housing market

What the Most Successful Remodelers are Doing Right Now

Industry advisor Mark Richardson shares the answers to his three most asked questions: What's the remodeling market like? What are other remodelers doing? How do I measure up?

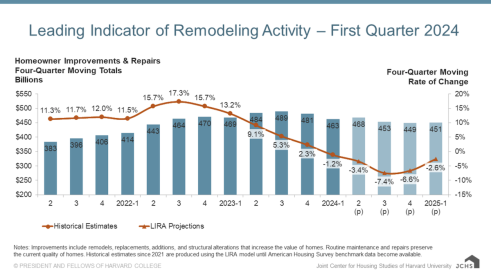

Harvard Says Remodeling Spending Downturn to Slow

Could the drop in remodeling spending from post-COVID levels regulate soon?

How to Increase Your Odds of Closing Remodeling Sales

Use these tips to hone your sales process and grow close ratio

The Remodeling Market Could Turn in Q4, Says Harvard

Repair and remodeling spending could see an uptick at the end of the year

How to Communicate with Today's Cautious Remodeling Client

Amid economic skepticism, Americans continue to spend. Now, how can you get them to spend on remodeling?