Industry Data & Research

Industry Data & Research

Industry data and research for professional home builders and remodelers.

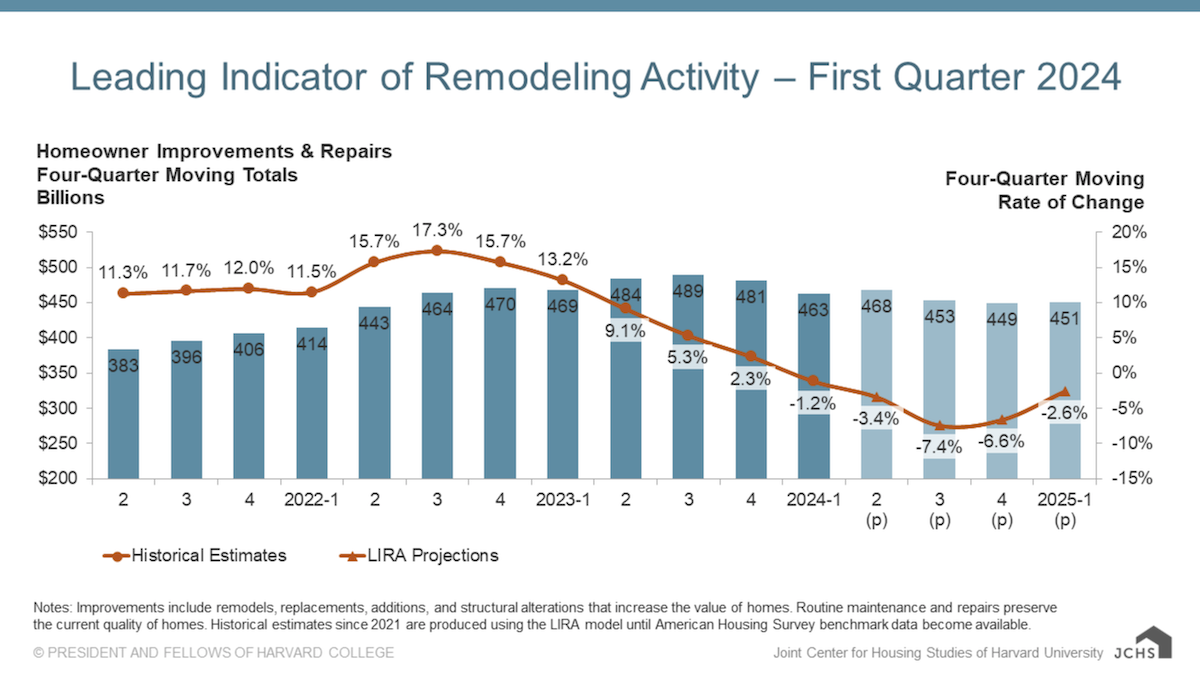

Harvard Says Remodeling Spending Downturn to Slow

Could the drop in remodeling spending from post-COVID levels regulate soon?

Industry Data & Research

The Latest Data on Construction's Workforce

To close the housing deficit in the United States, the industry needs more skilled workers. Here's where construction's workforce stands

News

The Remodeling Market Could Turn in Q4, Says Harvard

Repair and remodeling spending could see an uptick at the end of the year

NAHB

Building Materials Show Stability in 2023

Although supply chain bottlenecks have eased in recent months, shortages of some key materials persist.

Advertisement

Housing inventory declines in November

Data from real-estate brokerage firm ZipRealty Inc. showed that the number of homes for sale declined by 3.8 percent in November in 26 major metropolitan areas, the Wall Street Journal reported. The information covers single-family homes, condos and townhouses for sale in cities where the Emeryville, Calif.-based firm operates. The inventory of homes was still 11.6 percent higher than November of last year, however.

NAR: Pending home sales rise in October, Midwest has largest gains

The Pending Home Sales Index rose to 89.3 in October, a 10.4 percent gain over the previous month, according to the National Association of Realtors. The index, which is based on contracts during October, remained 20.5 percent lower than in October 2009, when the deadline for the homebuyers tax credit caused a surge.

Consumer confidence rises, but housing market remains flat

Consumer confidence in the U.S. increased in November, rising to its highest level in five months. The Conference Board’s sentiment index rose to 54.1, exceeding estimates by a Bloomberg survey of economists that it would increase to 53. Meanwhile, the Institute for Supply Management’s business gauge rose to it highest since April, indicating that business activity also is increasing.

S&P Case-Shiller report: Rate of home price decline may be accelerating

The S&P/Case-Shiller home-price indexes showed that home prices went down between August and September, and that third quarter prices also were down, according to a report by the Wall Street Journal. The indexes also indicated that the rate of decline may be accelerating.

Fannie Mae report: Americans less confident in housing market

A survey by Fannie Mae showed that Americans' confidence in the housing market dropped during the third quarter of 2010. The survey, which polled 3,417 households in July, August, and September, indicated that 85 percent think it is a bad time to sell a home, two percent higher than in June. Sixty-eight percent think it's a good time to buy a home, down two percent from June.

New single-family home sales down in October

The U.S. Census Bureau and Department of Housing and Urban Development reported today that new single-family home sales October were down 8.1 percent, to a seasonally-adjusted rate of 283,000, from the previous month. This rate was 28.5 percent lower than October 2009, which boasted 396,000 sales.

Existing home sales down in October

Existing home sales went down 2.2 percent in October, dropping to a seasonally adjusted rate of 4.43 million, according to the National Association of Realtors (NAR). Sales went down 25.9 percent compared to October 2009, when home sales were high due to the approaching deadline for the first-time buyer tax credit. Each of the four NAR regions reported drops in existing home sales.

Shadow Inventory of Homes Higher in 2010

The housing market’s “shadow inventory”—unlisted bank-owned homes and potential foreclosures—rose compared to 2009, according to a report by the Wall Street Journal. A report by CoreLogic, a real estate research firm, estimated that there were 2.1 million units in the shadow inventory in August, or about an eight-month supply. The number increased by 10 percent over August 2009.

Federal housing scorecard: Housing market recovery still fragile

The Obama administration’s monthly Housing Scorecard for November indicated that although the housing market remains fragile, home prices continue to stabilize and home affordability is up. The report noted that both new and existing home sales decreased compared to the first half of 2010, but this was expected following the expiration of the home buyer tax credit.

NAR survey: First-time home buyers increase in 2010

A survey by the National Association of Realtors (NAR) showed a major increase in the number of first-time home buyers in 2010. The 2010 NAR Profile of Home Buyers and Sellers surveyed consumers who purchased a home between July 2009 and June 2010. Fifty percent of purchasers during that period were first-time buyers, up from an average of around 40 percent during the last decade.