For most of its history, Dan and Matt Merrifield, brothers and co-owners of Lakeside Exteriors, saw nothing but steadily building sales at their St. Louis roofing, siding, and window company. But four years ago the building adjacent to their offices caught fire. Liability insurance covered the loss, and their building mainly suffered water damage. But it couldn’t cover the time the Merrifield brothers had to spend in their effort to resume normal business operations. As a result, the steady growth that Lakeside Exteriors had enjoyed up to that point flattened out as the owners struggled to recover.

“Our office was Dan’s basement, for the time being,” president Matt Merrifield says. “We operated like that for four months.” If the company had had cash reserves, Matt says, that might have been the time to use emergency funds to rent new space. Instead, he says, “we were stopped in our tracks.” This year, building a cash reserve is a priority for the Merrifields, with a separate bank account.

Emergency Fund or a Fund for Growth

Cash reserves are often considered more appropriate for large corporations. Though that comes with its own risk: Having excess capital stashed away makes a big company an ideal takeover target. But small-business experts and experienced contractors agree that just about any business needs some kind of capital reserve, even if it’s “a lump of excess cash in the bank above and beyond what your cash flow needs are,” says Tom Capizzi, owner of Capizzi Home Improvement, on Cape Cod, Mass., and co-owner of Marrokal Design & Remodeling, in San Diego.

That lump of cash can be a buffer against unexpected setbacks such as emergency repairs to equipment, or damages to a building that may not be covered by insurance, or lawsuits. Doug Cook, president of Feldco, a window and siding company with eight locations in the Upper Midwest, says that companies with a high percentage of jobs that are financed should be especially careful about having reserves. Say, for instance, a job disappears. “We’re advancing commissions and salaries for people who work on the project, we well as material costs,” Cook says. “If, God forbid, something happened to that customer, we’re left holding the bag.” Customer deposits are the biggest liability, he says. They are a contracted promise to build.

Cash reserves can also afford owners the chance to move on opportunities that they may otherwise have to pass up. For instance, in the 2008–2010 recession, when many home improvement companies pared back their marketing, Capizzi Home Improvement made the marketing investment that increased lead flow from 1,200 to 1,600 annually. Those additional leads enabled the company to hire two more salespeople.

In effect, a healthy cash reserve enables a business to lend itself money, at no cost. “Think of it as your own credit line,” suggests Leslie Shiner, CEO of The Shiner Group, a financial and management consulting organization in Mill Valley, Calif., that works with some of the country’s largest remodelers. If you’re self-funding growth, Shiner says, in effect, “you’re paying yourself 5 percent interest.”

Building a Cash Reserve

There is no mystery about where these cash reserves come from.

“It all comes out of net profit,” says Charles Gindele, president of Renewal by Andersen of Orange County, in California, who regularly teaches boot camps on business planning for Certified Contractors Network. “Every owner consciously or unconsciously decides what profit level is acceptable for the risk of owning and being in business,” he says.

Sound insurance and a cash reserve protect against that risk. If companies operate by running on whatever happens to be in the account at the moment, Gindele says, there will be no cash to salt away. If cash flow is managed well, cash reserves, to many companies, become possible and necessary. “The sophisticated companies have excess cash because they make profit,” Gindele says. “Before you can create a budget for it, you have to be in that bracket.”

If you are in that bracket, it becomes a matter of what formula to use in building your cash reserve. “Pick a number to put away every month and every year,” Capizzi suggests.

How much do you have, and how much do you need? Net profit is defined as the ratio of after-tax profit to net sales—what remains when all other costs are accounted for. So, for instance, Shiner says, if a company’s net profit is 7 percent, setting aside 2 percent as a cash reserve is one way to build that fund. Contribution to a reserve fund will vary, Doug Cook points out, since cash flow is seasonal for companies that work on exteriors.

And creating a target for cash reserve savings should be based on long-term planning, consultant Vaughn McCourt, a CPA who has worked in executive positions at several large home improvement companies, suggests. Anticipating the need for cash reserves should be based on an annual business plan and a five-year plan. That cash reserve goal, McCourt points out, takes into account equipment needs and “inventory, if you’re going to be distributing a different kind of product,” that is, expanding your product offering at some point.

Conventional wisdom suggests building cash reserves based on maintaining three months’ worth of working capital based on the daily operating costs of your business. But the decision is a personal one. And it can be quantified. For instance, 10 years ago, Doug Cook says, Feldco management sat down at a planning meeting and weighed “every possible thing that could harm us,” and attached an economic value to each. The exposure of holding customer deposits, and the need for disaster recovery and “different marginal consequences,” went into the company’s computation for cash reserve offsets.

Ready Access

You can put the cash you squirrel away in your checking account. The problem is, there it may be too liquid and end up being spent on needs other than emergencies or funding growth. Experts suggest putting the cash somewhere that’s liquid enough that you can easily tap into it if you really have the need, but not so liquid that it disappears in dribs and drabs. “There’s no good answer as to where to put it,” Shiner says. But certificates of deposit, with terms extending for months and years, would be a less than immediately accessible option. She and others suggest a separate savings account. And if you do find the need to tap into it, pay it back if you can.

Having cash reserves can offset unpredictable business setbacks or fund future growth

Add new comment

Related Stories

3 Areas Successful Remodelers Focus On

Industry advisor Mark Richardson shares what separates the losing from the winning in today’s market

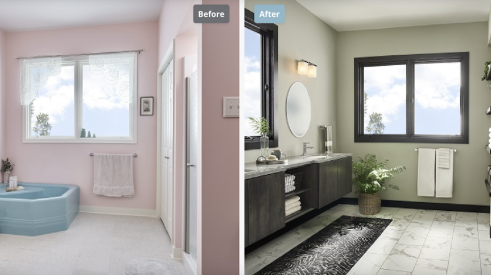

Peppermill Finish

NAHB: Remodelers Face Challenges and Opportunities

Remodelers face a uniquely strong market yet remain challenged by codes and costs

Selling Your Company to Your Team

From company valuation to terms of the transfer, here’s a look at how three different remodelers made the deal work

Re-Bath Expands its Reach with New Franchise

The company signs a deal with brothers who are first-time franchisees

Pro Remodeler’s 2024 Pinnacle Experience Reaches New Heights

The sold-out event covered leadership, lead gen, sales, and technology

Brian Gottlieb Receives Remodeling Mastery Award

Presented by industry icon, Mark Richardson, the award celebrated Gottlieb’s extraordinary impact on remodeling

What's Beyond the Hammer?

Working with Brian Gottlieb on the book Beyond the Hammer provided a masterclass on how to build an aligned team

5 Counterintuitive Strategies to Improve Your Business

Follow these strategies to inspire employees, instill trust, and beat the competition

Couple Act As Much More Than General Contractors

How LBR Partners uplifts and educates their Spanish-speaking trade partners