Remodelers’ confidence in the market dipped in the first quarter of 2013 when the Remodeling Market Index (RMI) fell six points to 49, according to the National Association of Home Builders (NAHB). Concern about the rising costs of construction materials and labor contributed to the pause in the general upward trend of remodelers’ confidence.

An RMI above 50 indicates that more remodelers report market activity is higher (compared to the prior quarter) than report it is lower. The overall RMI averages ratings of current remodeling activity with indicators of future remodeling activity.

“Remodelers remain optimistic about the outlook for growth in the remodeling market this year, but the rising cost of doing business makes it difficult to deliver the prices that many of our customers expect,” said 2013 NAHB Remodelers Chairman Bill Shaw, GMR, GMB, CGP, a remodeler from Houston. “Repairs and minor additions are currently the strongest categories of business for remodelers as home owners continue to invest in deferred maintenance and room-by-room remodeling.”

The future market indicators component of the RMI decreased from 56 in the previous quarter to 48. Current market conditions also fell from 54 in the previous quarter to 50. Remodelers indicated that activity was particularly strong in owner-occupied properties, rating all categories of remodeling in owner-occupied homes 51 or better.

“Although this quarter’s RMI indicates a pause in the improvement that the remodeling market had been showing, it is nevertheless the third highest reading for the RMI since the first quarter of 2006,” said NAHB Chief Economist David Crowe. “Like the rest of the home building industry, remodelers are starting to feel squeezed by higher costs and limited availability of labor and materials, which is unusual at such an early stage of a housing recovery. However, the downturn was so deep and extended that this time it may take a while to re-establish the supply chains.”

The RMI was 47 in the Northeast, 47 in the Midwest, 51 in the South and 52 in the West.

For more information about remodeling, visit www.nahb.org/remodel.

Related Stories

Peppermill Finish

NAHB: Remodelers Face Challenges and Opportunities

Remodelers face a uniquely strong market yet remain challenged by codes and costs

NAHB Announces Action Plan for Housing Affordability

Six of the proposed 10 action items are important to residential remodelers

Metros with the Highest and Lowest Remodel ROI

First-time homebuyers can find fixer-upper listings priced between 5 to 10% lower than move-in ready homes. The high return on investment of these projects shows that remodeling remains a strong option to navigate the current housing market

What the Most Successful Remodelers are Doing Right Now

Industry advisor Mark Richardson shares the answers to his three most asked questions: What's the remodeling market like? What are other remodelers doing? How do I measure up?

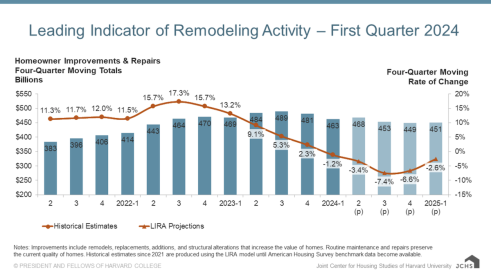

Harvard Says Remodeling Spending Downturn to Slow

Could the drop in remodeling spending from post-COVID levels regulate soon?

How to Increase Your Odds of Closing Remodeling Sales

Use these tips to hone your sales process and grow close ratio

The Remodeling Market Could Turn in Q4, Says Harvard

Repair and remodeling spending could see an uptick at the end of the year

How to Communicate with Today's Cautious Remodeling Client

Amid economic skepticism, Americans continue to spend. Now, how can you get them to spend on remodeling?