The second quarter results of the Remodeling Market Index (RMI) slipped under pressure from a softening labor market, according to the National Association of Home Builders (NAHB), dropping two points to 45. The downward adjustment comes after the RMI reached 48 twice in 2011, the highest reading since 2006.

The RMI is based on a quarterly survey of NAHB remodelers that asks them to rate current remodeling activity along with indicators of future activity, like calls for bids. An RMI below 50 indicates that more remodelers report market activity is lower (compared to the prior quarter) than report it is higher.

In the second quarter, the RMI component measuring current market conditions dropped to 46 from 49 in the previous quarter. The RMI component measuring future indicators of remodeling business remained unchanged at 44.

"Remodelers have some backlog of jobs and along with higher quality leads, this is making them cautiously optimistic about the near future," said NAHB Remodelers Chairman George "Geep" Moore Jr., GMB, CAPS, GMR and owner/president of Moore-Built Construction & Restoration Inc. in Elm Grove, La. "The positive outlook is constrained by continuing credit constraints and inaccurate appraisals that make customer financing difficult for big jobs like additions and whole house remodels."

In the South, the RMI rose by one point to 47, while in the West it was flat at 47. The RMI for the Northeast and Midwest regions fell by six points and four points, down to 42 and 46, respectively.

Among the detailed RMI components, two important indicators of future activity increased in the second quarter: backlog of jobs to 46 (from 43) and amount of work committed for the next three months to 43 (from 42). All indicators of current market conditions fell: major additions and alterations to 42 (from 44), minor additions and alterations to 47 (from 52) and maintenance and repairs to 50 (from 51).

Related Stories

Metros with the Highest and Lowest Remodel ROI

First-time homebuyers can find fixer-upper listings priced between 5 to 10% lower than move-in ready homes. The high return on investment of these projects shows that remodeling remains a strong option to navigate the current housing market

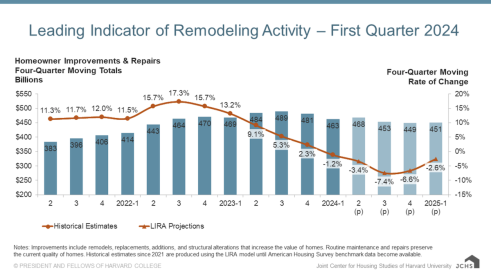

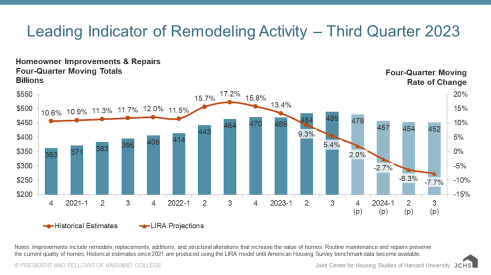

Harvard Says Remodeling Spending Downturn to Slow

Could the drop in remodeling spending from post-COVID levels regulate soon?

The Latest Data on Construction's Workforce

To close the housing deficit in the United States, the industry needs more skilled workers. Here's where construction's workforce stands

The Remodeling Market Could Turn in Q4, Says Harvard

Repair and remodeling spending could see an uptick at the end of the year

Building Materials Show Stability in 2023

Although supply chain bottlenecks have eased in recent months, shortages of some key materials persist.

Design Trends to Watch in 2024

What’s in and out for the upcoming year? Remodeling designers share insights

Remodeler Sentiment Remains Positive

Surveys reveal a strong outlook, and how the aging population will lift remodeling

Next Year to Challenge Remodeling, Says Harvard

The latest LIRA report predicts greater decrease in home improvement and remodeling spending

Top Siding and Window Colors for 2024

A recent survey identifies the top siding and window color choices for American homeowners

What Does the Past and Present of Remodeling Tell Us About the Future?

On this episode of Remodeling Mastery, industry advisor Mark Richardson shares bits of his keynote presentation at The Pinnacle Experience, highlighting different elements that shape the immediate future of the remodeling market