2013 was the year of the housing recovery. It was also the year of historically low vacancy rates for rental properties as Americans tended to err on the side of renting over buying. As the overall economy continues its slow but steady recovery in 2014, housing prices and interest rates are expected to keep rising and provide a further buoy to the housing market. However, this economic recovery also aids the rental market.

"As more Americans, especially the Millennial Generation, are able to secure employment and better jobs, we expect there to be a movement out of their parents' houses and temporary living situations, into rental properties," said Kirk McGary, CEO of Real Property Management.

According to some estimates and United States Census data, around 31 percent of 18-34 year olds in the U.S. lived with their parents in 2013, 44 percent of which did not have gainful employment. The U.S. unemployment rate hit a five-year-low this month to 7 percent, amidst continued strong job growth, signaling that things will be turning around financially for many Americans and thus improving living standards.

This new segment of renters will likely favor rental properties near larger cities and urban areas, meaning a lot of the top rental markets will continue to see a rise in demand.

As for Americans looking to buy in the coming year, new mortgage standards set to take effect in January and rising interest rates will make it more difficult to secure a mortgage in 2014, meaning many will continue to rent.

"Quite a few families were burned by foreclosures and bad mortgages during the housing crisis, the result of which is wariness on both sides of the equation," said McGary. "You have lenders being cautious and individuals being cautious of borrowing large sums again."

"We're going to see some demographic and supply and demand shifts within the rental market in 2014, but all in all, the market will remain strong for investors and stakeholders," added McGary. PR

Related Stories

Peppermill Finish

NAHB: Remodelers Face Challenges and Opportunities

Remodelers face a uniquely strong market yet remain challenged by codes and costs

NAHB Announces Action Plan for Housing Affordability

Six of the proposed 10 action items are important to residential remodelers

Metros with the Highest and Lowest Remodel ROI

First-time homebuyers can find fixer-upper listings priced between 5 to 10% lower than move-in ready homes. The high return on investment of these projects shows that remodeling remains a strong option to navigate the current housing market

What the Most Successful Remodelers are Doing Right Now

Industry advisor Mark Richardson shares the answers to his three most asked questions: What's the remodeling market like? What are other remodelers doing? How do I measure up?

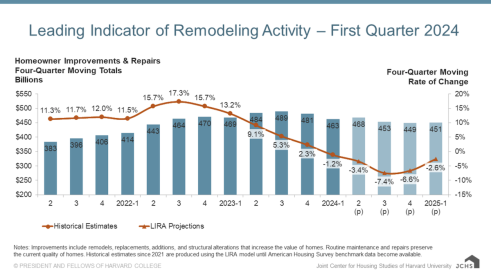

Harvard Says Remodeling Spending Downturn to Slow

Could the drop in remodeling spending from post-COVID levels regulate soon?

How to Increase Your Odds of Closing Remodeling Sales

Use these tips to hone your sales process and grow close ratio

The Remodeling Market Could Turn in Q4, Says Harvard

Repair and remodeling spending could see an uptick at the end of the year

How to Communicate with Today's Cautious Remodeling Client

Amid economic skepticism, Americans continue to spend. Now, how can you get them to spend on remodeling?