Following a flat report in May, the Trulia Price Monitor for June shows that the asking prices for homes listed for sale in the 100 largest metro areas were up 0.3 percent last month (both YoY and MoM). Rents increased 5.4 percent YoY, outpacing price increases in most markets.

“Since February, asking prices showed solid gains in four out of five months, including in June, so I expect to see the sales-price indexes show further increases in the months to come,” said Jed Kolko, Trulia’s chief economist.

The metros with the largest asking price increase (YoY) in June include:

1. Phoenix - 18.9%

2. Miami - 16.1%

3. Cape Coral-Fort Myers, Fla. - 14.9%

4. West Palm Beach, Fla. - 9.6%

5. Denver - 7.2%

6. Orlando - 6.8%

7. Warren-Troy-Farmington Hills, Mich. - 6.5%

8. San Jose - 6.2%

9. Detroit - 5.2%

10. Pittsburgh - 5.1%

Kolko said the metros with rising prices fall into two groups:

1. Miami, Phoenix, Detroit, and many other “at-risk” metros still have a high share of homes still in foreclosure, and their price gains will shrink or even reverse as those foreclosed homes come onto the market. The metros with the very highest price increases are all “at-risk.”

2. Denver, San Jose, Pittsburgh, and many others have strong price gains with a moderate or low share of homes still in foreclosure. These markets are “in the clear” and should hold their gains. “In the clear” markets also have stronger job growth and a more quickly rebounding construction industry than “at-risk” markets.

“The huge price gains we’ve seen in Miami and Phoenix are not built to last. These increases will shrink or reverse as the backlogged foreclosures in these metros hit the market,” said Kolko. “In contrast, Denver, San Jose and Austin, which were spared the worst of the housing crisis, have strong price growth and strong job growth without a foreclosure overhang. Their recent price gains are less dramatic than Miami and Phoenix but are less at risk. Slow and steady wins the housing recovery.”

For more on the report, visit: http://info.trulia.com/trulia-price-and-rent-monitor-june-2012

Related Stories

Peppermill Finish

NAHB: Remodelers Face Challenges and Opportunities

Remodelers face a uniquely strong market yet remain challenged by codes and costs

NAHB Announces Action Plan for Housing Affordability

Six of the proposed 10 action items are important to residential remodelers

Metros with the Highest and Lowest Remodel ROI

First-time homebuyers can find fixer-upper listings priced between 5 to 10% lower than move-in ready homes. The high return on investment of these projects shows that remodeling remains a strong option to navigate the current housing market

What the Most Successful Remodelers are Doing Right Now

Industry advisor Mark Richardson shares the answers to his three most asked questions: What's the remodeling market like? What are other remodelers doing? How do I measure up?

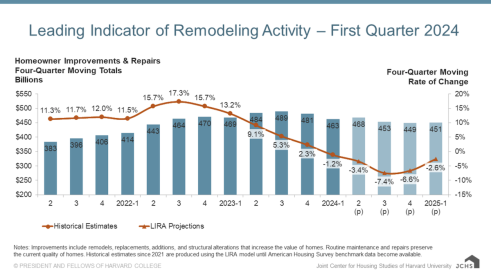

Harvard Says Remodeling Spending Downturn to Slow

Could the drop in remodeling spending from post-COVID levels regulate soon?

How to Increase Your Odds of Closing Remodeling Sales

Use these tips to hone your sales process and grow close ratio

The Remodeling Market Could Turn in Q4, Says Harvard

Repair and remodeling spending could see an uptick at the end of the year

How to Communicate with Today's Cautious Remodeling Client

Amid economic skepticism, Americans continue to spend. Now, how can you get them to spend on remodeling?