WOLF, a supplier of kitchen cabinets and building products in the U.S., reported the findings of the WOLF Key Buyer Index (KBI) for May 2014.

The May 2014 KBI score of 73.64 is continued evidence that the market has found its footing from a weak beginning of the year and the summer will be stronger.

WOLF developed KBI, a proprietary metric that offers a monthly snapshot of independent dealers’ sentiments, to provide a concrete measure of how building materials buyers see the near-term future of their industry. WOLF gathers data for the KBI from a monthly survey of key buyers at independent building materials dealers across 26 states. A WOLF KBI score of 50 reflects a neutral outlook; a score above 50 reflects a positive outlook; and a score below 50 reflects a negative outlook. Here’s a regional breakdown:

Mid Atlantic region

Early summer vacations and other end-of-school activities in the Mid Atlantic resulted in a slight dip in that region’s kitchen and bath and building products scores. Still, building products business confidence continues to increase each month of this year to a current high of 82.00. Over 95 percent of those surveyed believe business will remain as good or better in the coming months, and favorable weather is allowing for steady work on most interior and exterior building projects.

Northeast region

Despite a slight overall decrease in the Northeastern states’ KBI (from 78.89 to 77.78), the entire region continues to be very bullish. The feeling is that pent up demand for projects is kicking in after a brutal winter. Kitchen-at-a-time traffic continues to pick up, and there has been a significant uptick in large project quotes and orders.

The overall KBI score of 73.64 sets the expectation of continued growth barring any major disruption in external factors and/or consumer behavior. Project work is plentiful in both kitchen and bath and building products sectors, allowing dealers and contractors to recoup lost profits from a slow 2014 start.

For more information on the WOLF Key Buyer Index, read the detailed explanation or see the latest KBI score at www.wolfleader.com. PR

Related Stories

Peppermill Finish

NAHB: Remodelers Face Challenges and Opportunities

Remodelers face a uniquely strong market yet remain challenged by codes and costs

NAHB Announces Action Plan for Housing Affordability

Six of the proposed 10 action items are important to residential remodelers

Metros with the Highest and Lowest Remodel ROI

First-time homebuyers can find fixer-upper listings priced between 5 to 10% lower than move-in ready homes. The high return on investment of these projects shows that remodeling remains a strong option to navigate the current housing market

What the Most Successful Remodelers are Doing Right Now

Industry advisor Mark Richardson shares the answers to his three most asked questions: What's the remodeling market like? What are other remodelers doing? How do I measure up?

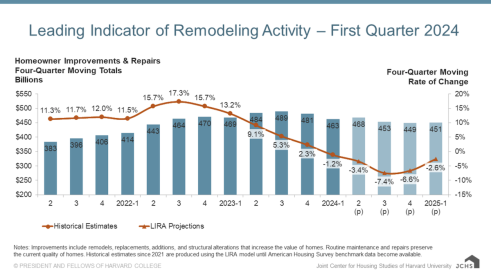

Harvard Says Remodeling Spending Downturn to Slow

Could the drop in remodeling spending from post-COVID levels regulate soon?

How to Increase Your Odds of Closing Remodeling Sales

Use these tips to hone your sales process and grow close ratio

The Remodeling Market Could Turn in Q4, Says Harvard

Repair and remodeling spending could see an uptick at the end of the year

How to Communicate with Today's Cautious Remodeling Client

Amid economic skepticism, Americans continue to spend. Now, how can you get them to spend on remodeling?