Lenders took back more homes in August than in any month since the start of the U.S. mortgage crisis. In all, banks repossessed 95,364 properties last month, up 3 percent from July and an increase of 25 percent from August 2009, RealtyTrac said. August makes the ninth month in a row that the pace of homes lost to foreclosure has increased on an annual basis. The previous high was in May.

The increase in home repossessions came even as the number of properties entering the foreclosure process slowed for the seventh month in a row, foreclosure listing firm RealtyTrac Inc. Banks have been stepping up repossessions to clear out their backlog of bad loans with an eye on eventually placing the foreclosed properties on the market, but they can't afford to simply dump the properties on the market. That's one reason fewer than one-third of homes repossessed by lenders are on the market.

The number of properties receiving an initial default notice -- the first step in the foreclosure process -- slipped 1 percent last month from July, but was down 30 percent versus August last year, RealtyTrac said. Initial defaults have fallen on an annual basis the past seven months. They peaked in April 2009. Still, the number of homes scheduled to be sold at auction for the first time increased 9 percent from July and rose 2 percent from August last year. If they don't sell at auction, these homes typically end up going back to the lender.

More than 2.3 million homes have been repossessed by lenders since the recession began in December 2007, according to RealtyTrac. The firm estimates more than 1 million American households are likely to lose their homes to foreclosure this year.

Related Stories

Remodeling Spending To Tick Up Through Mid-2025

The Leading Indicator of Remodeling Activity report says things will trend up after a modest downturn

6 Strategies to Optimize Gross Profit

Thoroughly estimating and tracking gross profits is the life blood of a business, and one remodeler shares the approach that works well for his firm

Wellborn Cabinet - Peppermill Finish

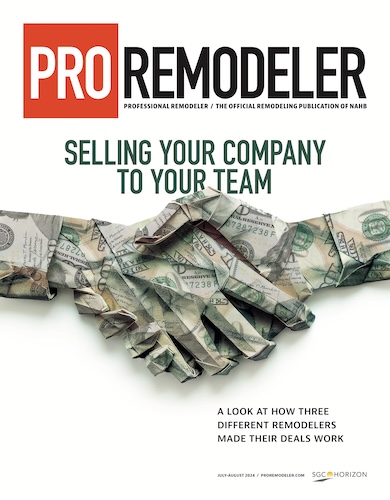

Selling Your Company to Your Team

From company valuation to terms of the transfer, here’s a look at how three different remodelers made the deal work

What's Beyond the Hammer?

Working with Brian Gottlieb on the book Beyond the Hammer provided a masterclass on how to build an aligned team

4 Steps to Prep Your Business for Contraction

How a remodeling company plans ahead for the worst of times (and the best of times)

Creating a Company Fire Drill: How to Prepare for the Worst

A disastrous fire could have been a lot worse if the business wasn’t prepared for the unexpected

The Fundamentals of Growing Profitably

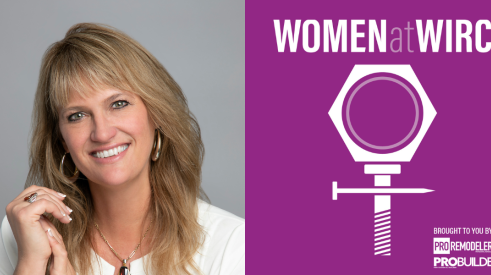

On this episode of Women at WIRC podcast, Nip Tuck Remodeling Owner April Bettinger shares how she plans for her company's profitable growth

3 Things to Add to Your Construction Contract—From a Lawyer

Did you know you can add these three elements to your contracts?