Market Conditions

Market Conditions

Remodeling Spending To Tick Up Through Mid-2025

The Leading Indicator of Remodeling Activity report says things will trend up after a modest downturn

NAHB

NAHB: Remodelers Face Challenges and Opportunities

Remodelers face a uniquely strong market yet remain challenged by codes and costs

NAHB

NAHB Announces Action Plan for Housing Affordability

Six of the proposed 10 action items are important to residential remodelers

Market Conditions

Metros with the Highest and Lowest Remodel ROI

First-time homebuyers can find fixer-upper listings priced between 5 to 10% lower than move-in ready homes. The high return on investment of these projects shows that remodeling remains a strong option to navigate the current housing market

Advertisement

2011 Remodeling Forecast: Three Reasons for Long-Term Optimism

Beyond the next few years, there are several reasons to be optimistic about the long-term outlook for the remodeling market, with demographics and an…

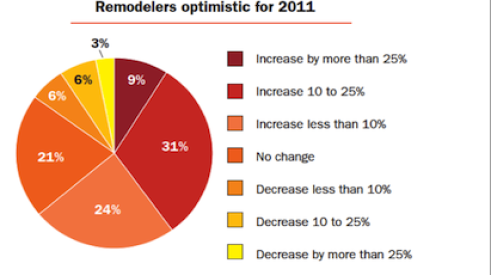

2011 Forecast: Remodeling market poised for growth

While challenges persist, remodelers are more optimistic about the 2011 remodeling market than they’ve been since the housing boom.

Housing inventory declines in November

Data from real-estate brokerage firm ZipRealty Inc. showed that the number of homes for sale declined by 3.8 percent in November in 26 major metropolitan areas, the Wall Street Journal reported. The information covers single-family homes, condos and townhouses for sale in cities where the Emeryville, Calif.-based firm operates. The inventory of homes was still 11.6 percent higher than November of last year, however.

NARI submits letter to Senate on lead rule

The National Association of the Remodeling Industry (NARI) submitted a letter to the U.S. Senate’s Committee on Small Business and Entrepreneurship, which has called a hearing on regulatory issues small business face. The letter centers on the U.S. Environmental Protection Agency’s (EPA) Lead Renovation Repair and Painting rules (LRRP).

NAR: Pending home sales rise in October, Midwest has largest gains

The Pending Home Sales Index rose to 89.3 in October, a 10.4 percent gain over the previous month, according to the National Association of Realtors. The index, which is based on contracts during October, remained 20.5 percent lower than in October 2009, when the deadline for the homebuyers tax credit caused a surge.

Consumer confidence rises, but housing market remains flat

Consumer confidence in the U.S. increased in November, rising to its highest level in five months. The Conference Board’s sentiment index rose to 54.1, exceeding estimates by a Bloomberg survey of economists that it would increase to 53. Meanwhile, the Institute for Supply Management’s business gauge rose to it highest since April, indicating that business activity also is increasing.

S&P Case-Shiller report: Rate of home price decline may be accelerating

The S&P/Case-Shiller home-price indexes showed that home prices went down between August and September, and that third quarter prices also were down, according to a report by the Wall Street Journal. The indexes also indicated that the rate of decline may be accelerating.

Fannie Mae report: Americans less confident in housing market

A survey by Fannie Mae showed that Americans' confidence in the housing market dropped during the third quarter of 2010. The survey, which polled 3,417 households in July, August, and September, indicated that 85 percent think it is a bad time to sell a home, two percent higher than in June. Sixty-eight percent think it's a good time to buy a home, down two percent from June.

New single-family home sales down in October

The U.S. Census Bureau and Department of Housing and Urban Development reported today that new single-family home sales October were down 8.1 percent, to a seasonally-adjusted rate of 283,000, from the previous month. This rate was 28.5 percent lower than October 2009, which boasted 396,000 sales.

Existing home sales down in October

Existing home sales went down 2.2 percent in October, dropping to a seasonally adjusted rate of 4.43 million, according to the National Association of Realtors (NAR). Sales went down 25.9 percent compared to October 2009, when home sales were high due to the approaching deadline for the first-time buyer tax credit. Each of the four NAR regions reported drops in existing home sales.